Investing in the stock market has become much simpler today, thanks to digital tools that streamline the process. Among these tools, a Demat account is vital for holding and managing shares electronically. Opening a free Demat account eliminates account maintenance charges, making it easier for both new and experienced investors to start their journey. Whether your focus is IPO investment or following a systematic SIP strategy, a free Demat account offers multiple advantages to help you manage your investments efficiently.

What is a Free Demat Account?

A Demat account, short for “Dematerialized Account,” allows investors to store shares, bonds, and other securities in electronic form. Unlike traditional paper-based certificates, a Demat account securely keeps all your holdings digitally, reducing risks of theft, loss, or damage.

A free Demat account, as the name suggests, comes without annual maintenance charges. This makes it an attractive choice for beginners looking to start investing without incurring additional costs. With such an account, investors can easily participate in IPOs, track their SIPs, and manage multiple securities without worrying about fees affecting their returns.

Key Benefits of a Free Demat Account

Simplified Portfolio Management

One of the biggest advantages of a free Demat account is the convenience of managing all investments in one place. You can monitor your holdings, dividends, and transaction history in real-time. Digital tracking eliminates paperwork and reduces the chances of mistakes, making portfolio management much easier.

Cost-Effective Investment

Traditional Demat accounts may charge annual maintenance fees, which can reduce overall returns. A free Demat account removes this barrier, ensuring your investment profits stay intact. This cost efficiency is particularly beneficial when following a long-term SIP plan or participating in multiple IPO investments.

Quick and Seamless Transactions

With a free Demat account, buying and selling securities becomes fast and hassle-free. Unlike physical share certificates that require time-consuming processes, electronic holdings allow instant settlement. This speed is crucial for IPO investments where timing plays a key role in allotment.

Enhanced Security

Electronic storage of investments ensures higher security compared to physical certificates. A free Demat account provides features such as secure login methods and two-factor authentication, protecting your portfolio from unauthorized access or theft. Investors can manage a diverse set of securities confidently and safely.

Role of a Free Demat Account in IPO Investment

IPO investment allows investors to buy shares of a company before they are publicly listed. A free Demat account simplifies the entire process, as allotted shares are automatically credited to the account in digital form. This avoids the need for physical certificates and ensures quick access to your newly acquired shares.

Moreover, having a free Demat account encourages active market participation. Investors can efficiently track IPO allotments, analyze opportunities, and manage multiple subscriptions without additional costs, making it an ideal tool for growth-oriented investment strategies.

Supporting Long-Term Goals with SIP

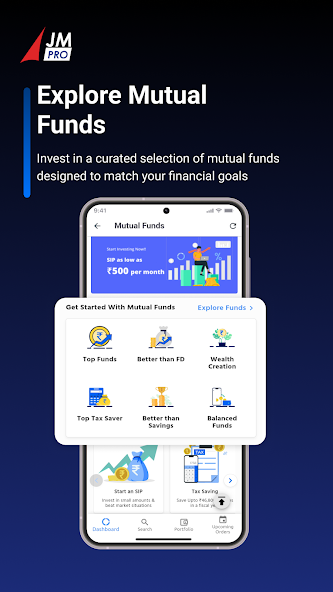

Systematic Investment Plans (SIPs) are an effective method to accumulate wealth over time through regular contributions. A free Demat account complements SIP investments by providing a consolidated platform for monitoring all mutual fund units digitally.

Instead of managing multiple physical documents, you can view your SIP investments in one place. This organized approach helps track performance, reinvest dividends, and maintain financial discipline. By reducing costs and simplifying tracking, a free Demat account enhances the effectiveness of long-term SIP strategies.

Additional Advantages

Consolidated Portfolio

A free Demat account allows you to hold different types of investments—stocks, bonds, ETFs, and mutual funds—under a single account. This unified structure simplifies portfolio management and offers a clear overview of your investment strategy.

Paperless Operations

All transactions in a Demat account are digital, reducing administrative hassles and environmental impact. E-statements, digital alerts, and online transaction summaries help investors stay informed and organized.

Flexibility in Trading

A free Demat account is compatible with multiple trading platforms, allowing investors to trade anytime and from anywhere. This flexibility is especially beneficial when participating in IPOs or managing time-sensitive investment opportunities.

Conclusion

Opening a free Demat account is a practical step for investors aiming to reduce costs while gaining full control over their portfolio. It simplifies investment management, ensures faster transactions, and provides enhanced security. For those planning IPO investment or a disciplined SIP approach, a free Demat account allows seamless, organized, and cost-effective investing. By leveraging these benefits, investors can create a structured and secure pathway toward long-term financial growth.