Building long-term financial stability requires a steady and disciplined approach, and this is where a Sip Online plan becomes an effective choice for many investors. When you begin investing through a Sip Online method, you gradually build wealth by contributing a fixed amount at regular intervals. Many people prefer using an Online Trading App because it allows them to track investments, schedule monthly contributions, and simplify the entire process. With both technology and accessible investment options, securing your future becomes easier and more systematic.

A Sip Online strategy ensures you remain consistent with your investments without stressing about market movement or daily financial decisions. By spreading investments over time, you reduce the pressure of timing the market and slowly develop a habit of planned financial growth. Whether you are new to investing or already familiar with market-linked options, using an Online Trading App for systematic investing can help you stay organized and maintain discipline. This explains how a Sip Online plan works, its benefits, and how to build a sustainable strategy for long-term security.

Understanding the Concept of a Sip Online Plan

A Sip Online plan refers to investing a fixed amount in market-linked options at regular intervals. Instead of making a large investment at once, you spread your contribution over months or years. This approach brings consistency and reduces financial burden.

How Sip Online Works

- You choose the investment type you want to contribute to.

- Decide the amount you want to invest every month.

- Select a date for the contribution.

- Your investment continues automatically at the set frequency.

Because the process is digital, any Online Trading App allows you to start, pause, increase, or modify these investments whenever necessary.

Benefits of Choosing a Sip Online Plan

Helps Build Financial Discipline

One of the biggest advantages of a Sip Online plan is the sense of discipline it brings. With monthly contributions, you get used to setting money aside before spending. Over time, this disciplined habit becomes a strong foundation for financial security.

Enables Gradual Wealth Growth

Since Sip Online involves consistent contributions, your investments grow steadily. You do not need to wait for large funds to begin investing. Small, regular amounts accumulate over time and create a sizable portfolio.

Reduces the Impact of Market Movement

Market fluctuations can be unpredictable. A Sip Online plan helps average out the purchase cost of units because you invest at different price points over time. This reduces the risk of investing a large amount at the wrong time.

Suitable for Long-Term Goals

Long-term objectives like retirement planning, children’s education, home building, or future savings become easier with a Sip Online approach. The gradual nature of investing aligns well with long-term financial commitments.

Easy to Track and Manage

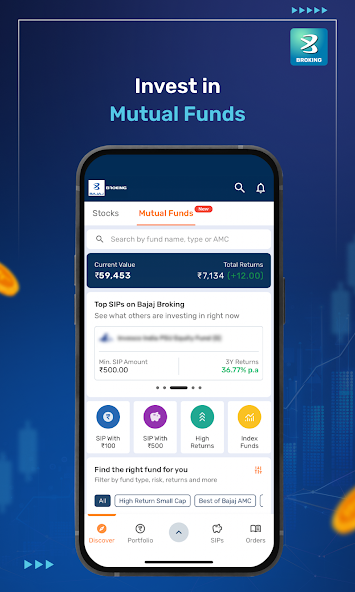

When you manage your investments through an Online Trading App, monitoring becomes convenient. Most apps show your investment value, growth, contribution history, and performance trends, helping you stay updated at all times.

Steps to Start a Sip Online Plan

Evaluate Your Financial Goals

Before starting any investment, it is important to determine your short-term and long-term objectives. This helps you decide how much to invest and for how long. Define whether your goals are related to wealth creation, saving for future needs, or building security.

Decide the Monthly Investment Amount

Your monthly contribution depends on your income, expenses, and goals. Even a small amount can grow significantly over time when invested consistently.

Use an Online Trading App for Setup

Most investors prefer setting up their Sip Online plan using an Online Trading App. The setup process is simple:

- Select the investment option.

- Choose a monthly investment value.

- Pick a date for automatic deduction.

- Confirm and activate the plan.

Monitor Your Plan Periodically

Even though Sip Online plans are designed for automatic investing, periodic review is important. Check whether your goals remain unchanged or if your financial capacity improves. If needed, you may increase your monthly investment.

Why Consistency Matters in Sip Online Investing

Encourages Long-Term Growth

Consistent investing allows your investments to grow over years, not weeks or months. This long-term outlook is essential for building a stable financial future.

Helps Develop a Saving Habit

A fixed monthly contribution develops a habit of saving before spending. This simple discipline improves financial planning and reduces unnecessary expenses.

Minimizes Emotional Decisions

Market highs and lows often cause emotional reactions. However, with a Sip Online plan, your investment schedule remains constant, preventing impulsive decisions influenced by market emotions.

Tips to Make Your Sip Online Plan More Effective

Start Early

The earlier you start investing, the more time your investments have to grow. Starting early gives you a longer window to build wealth.

Increase Contribution Over Time

Whenever your income increases or expenses reduce, try increasing your monthly investment amount. Even small increases can make a huge difference over the long run.

Stay Invested During Market Volatility

Avoid stopping your Sip Online plan during market fluctuations. In fact, investing consistently during low markets often benefits investors in the long run.

Review Your Objectives Annually

Every year, review your financial goals and check whether the current Sip Online plan aligns with them. Make changes if required to stay on track.

Conclusion

A consistent Sip Online plan is one of the most effective ways to build long-term financial security. When combined with the convenience of an Online Trading App, managing and tracking investments becomes simple and accessible for anyone. With regular contributions, market-cost averaging, and long-term discipline, a Sip Online plan helps you grow your wealth steadily and responsibly.

By investing small amounts at regular intervals, you create a routine that supports your future goals. Using an Online Trading App ensures your investments stay organized and easy to monitor. Whether you are planning for future security or long-term growth, a disciplined Sip Online strategy gives you a dependable path to achieving your financial goals.