Financial crises like medical bills, home repairs, and vacations can happen unexpectedly in today’s fast-paced environment. Most consumers cannot wait days or weeks for a regular bank loan in such instances. More borrowers are using online fast loans to solve their financial problems.

Digital banking and fintech apps make instant loan online easier, faster, and more convenient. Here’s why salaried professionals, small business owners, students, and homemakers are using online fast loans.

1. Instant loan approval and disbursement

The increased desire is most likely due to speed. Online instant loans are granted in minutes, unlike traditional banks that may take days. Many platforms guarantee rapid loan approval and 15–30-minute deposits.

Time-sensitive emergencies benefit from this fast technique. The demand for immediate personal loans has created a market where fintech lenders compete on processing, approval, and disbursement speed.

2. Easy Documentation

Paperwork is one of the worst components of traditional loans. Payslips, tax records, job documentation, bank statements, and more are needed. Application for a fast loan online normally takes only your Aadhaar card, PAN card, and income verification, most of which can be provided digitally.

Many apps use eKYC (electronic Know Your Customer) for real-time verification and approval, saving time and effort.

3. No Collateral Required

Many people fear losing their collateral—gold, property, or vehicles—when applying for traditional loans. However, most rapid personal loan companies offer unsecured loans, so you don’t have to mortgage any assets.

This makes online fast loans accessible to more people, even those without property or other assets.

4. Application and 24/7 Access

Banking hours don’t apply online. A smartphone app or website can help you get a fast loan at 2 AM or on a national holiday. This 24/7 availability lets consumers get credit when they need it without time constraints.

Many rapid loan online lenders offer AI-enabled bots that help applicants 24/7.

5. Higher Salaried and Self-Employed Approval Rates

Fintech companies evaluate creditworthiness with complex algorithms. Online fast loan systems consider transaction history, employment patterns, and utility bill payments instead of obsolete credit models. This comprehensive strategy allows immediate personal loans for persons with weak or poor credit.

These platforms offer equal funding opportunities to freelancers, gig workers, and self-employed entrepreneurs.

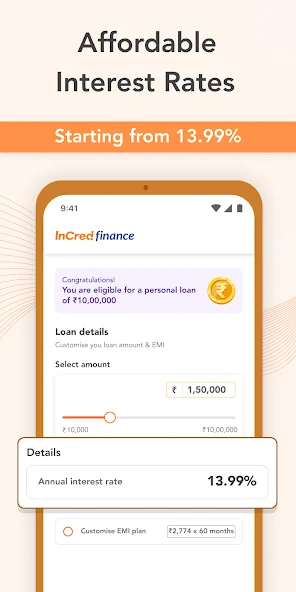

6. Customization, Transparency

Modern loan apps provide the interest rate, EMI, payback term, and processing fees upfront. You can choose your loan amount and repayment period to fit your budget.

Another reason many favor online rapid loans over traditional methods is openness, which fosters trust and helps customers make informed decisions.

7. User-Friendly Mobile Apps

Most instant personal loan companies employ simple mobile apps. Interactive interfaces, chat support, reminders, and real-time updates let consumers control everything from application to EMI payments.

Credit score tracking, loan calculators, and pre-approved offers make financial management easier for most users using these apps.

Conclusion:

Online fast loans make sense in a world when time is money and convenience rules. Without collateral, they offer fast approval, minimal paperwork, flexible repayment, and access from anywhere. If you need cash fast, a swift personal loan may be the solution for paid workers and freelancers.

As technology advances, rapid lending online platforms will become more efficient and inclusive. The key is to borrow responsibly. To avoid debt, study the terms and conditions, check the repayment schedule, and make sure you can pay your EMIs on time.